Low wages and rising household debt is not a sound basis for any economy. Today's news that spending on credit and debit cards is rising five times faster than wages, should set off the economic alarm bells.

At every recent UK budget, I tweet and blog the one chart in the OBR report that I find particularly scary – household debt. This is what I said in March this year:

This chart is scary because every year it shows that household debt is projected to rise. With wages in real decline the UK government expects households to pick up the slack caused by their austerity economics.

This chart is scary because every year it shows that household debt is projected to rise. With wages in real decline the UK government expects households to pick up the slack caused by their austerity economics.

These chickens are now coming home to roost. Real incomes have fallen for three successive quarters, the first time this has occurred since the International Monetary Fund bailed the UK out in 1976. Despite saving less and borrowing more, consumer spending has fallen, resulting in economic growth of 0.2% – the lowest of any of the major G7 industrial nations.

Here is a Guardian graphic illustrating the point using ONS data.

As Frances O’Grady, the TUC general secretary, puts it: “People raiding their piggy banks is bad news for working people and the economy. But with wages falling as living costs rise, many families are having to run down their savings or rely on credit cards and loans to get through the month.”

Low pay isn’t doing productivity any favours either. This chart from the Independent shows that productivity has now fallen below 2007 levels.

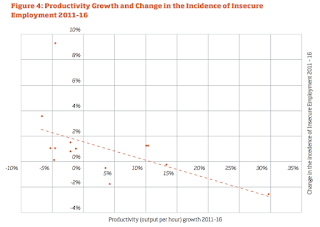

There is more evidence in a recent TUC report on insecure work, which found that those sectors which had seen higher increases in productivity over the last five years tended to be those which had experienced smaller increases in insecure employment.

What governments at UK and devolved levels need is a plan to get wages rising again. They must stop holding down the pay of public sector workers by scrapping the pay cap. The minimum wage needs to rise faster reaching £10 an hour as soon as possible and stronger employment rights to tackle bogus self-employment and other forms of insecure work.

For this to happen we apparently need a 'magic money tree'. Here are a couple of branches for that tree.

Let’s have a look at those who have been doing really well out of austerity – the richest 1%. As a report by the Resolution Foundation shows, they have recouped all their losses from the slump. Some action on tax dodging would be a start as well as halting the tax cuts that simply are not trickling down.

Another is the Robin Hood Tax. Professor Avinash Persaud has recently fleshed out a few aspects of this long standing campaign. He argues that Britain already has a financial transaction tax – it’s called stamp duty, It raises just over £3bn a year, half of it from overseas citizens. Some trading activities are exempt from stamp duty and he believes these exemptions should be restricted. He also proposes that the tax should be broadened to cover transactions in corporate bonds and cash flows arising from equity and derivative transactions. He estimates that this would raise £4.7bn a year - a pretty hefty branch for any magic money tree.

A low wage, low productivity economy is just not the way to go. We need to get wages rising, not least in the public sector after seven years of pay restraint. A different type of economy is possible and we have the wealth to support it.

A low wage, low productivity economy is just not the way to go. We need to get wages rising, not least in the public sector after seven years of pay restraint. A different type of economy is possible and we have the wealth to support it.

No comments:

Post a Comment