IT in the public sector doesn’t have a positive image, although many of the high profile failures are large scale projects such as the Universal Credit. It should also be remembered that large scale private sector IT failures also abound, as any RBS customer can testify.

As a consequence the UK government has now adopted a more decentralised approach, seeking to encourage innovation and local solutions. The Scottish Government is developing the approach in the McClelland Report, that seems to us to be predicated on big IT solutions.

The IPPR has published a new report focusing on grassroots projects that develop technological solutions to specific problems rather than standardised ‘off-the-shelf’ products. They focus on frontline tools that interact directly with practitioners and users.

The case studies in this report also illustrate how technology can improve the quality of public services by transforming the experience of people delivering and receiving these services. They can also free up professional time to focus on service delivery and generate savings through early intervention. The sort of preventative spending recommended by the Christie Commission.

Large-scale, top-down public sector technology programmes have been beset by problems. This report suggests that encouraging grassroots innovation is the best path to successful tech-powered services.

Public Works is UNISON Scotland's campaign for jobs, services, fair taxation and the Living Wage. This blog will provide news and analysis on the delivery of public services in Scotland. We welcome comments and if you would like to contribute to this blog, please contact Kay Sillars k.sillars@unison.co.uk - For other information on what's happening in UNISON Scotland please visit our website.

Friday, 20 December 2013

Next June before workers pay off Xmas debts

It will take average-income families until next June to pay off their Christmas debts, according to new analysis published by the TUC. This analysis shows how falling real wages and lower household savings will make it harder for borrowers to repay their credit cards and loans in 2014.

Last Christmas, one in six families borrowed money to pay for food, drinks and presents, with households borrowing an average of £654 per adult (Men £1,000, women £547). Using average weekly earnings and savings data the TUC estimated that it took average-income earners 20 weeks to pay off this debt. This year, consumer debt has increased by 4.9 per cent. The TUC estimates this will lead to average debts of £685 per adult this Christmas. With real wages and savings lower than last year the TUC calculates it will therefore take 24 weeks for an average-income earner to pay back this money.

However, if a minimum wage worker were to borrow this sum it would take them an entire year working full-time to pay it off. Research published by Consumer Intelligence in October showed that nearly half of all families who borrowed during last year’s festive season still haven’t finished repaying this money.

The TUC says the findings underline once again how ordinary people are not benefiting from the recovery and are instead facing a bigger struggle to pay off their debts. British workers are currently suffering the longest real-wage squeeze since the 1870s, with inflation rising faster than wages for the last 42 months. With real wage growth forecast to be weak for the next four years as set out by the OBR - governments in Scotland and UK need to prioritise wage growth.

Tuesday, 17 December 2013

Cutting public sector jobs and pay

On Monday, UNISON launched our new 'Worth It' campaign. We all expect high quality public services but funding cuts mean that budgets are under pressure and staffing has been reduced. On top of that, UNISON members have suffered a real terms pay cut of between 8 and 17%. That damages the local economy as well as essential services.

Very relevant to the 'Worth It' theme is a recent IFS analysis, 'Hard choices ahead for government cutting public sector employment and pay'.

The Office for Budget Responsibility (OBR) forecast, based on the 2013 UK budget, that general government employment (that is employment by central and local government) would fall by 1 million between 2010–11 and 2017–18. However, following the Chancellor's latest cuts, they have increase the forecast to a cut of 1.1 million by 2018–19. In Scotland, public sector employment has been cut by around 58,000 since the financial crash and based on this forecast I calculate that we can expect to lose around a further 60,000 jobs by 2018.

If this isn't bad enough, the IFS also noted the OBR forecast reductions to growth in public sector pay. Public sector pay is now forecast to be 3.6% lower in 2017–18 than expected in June, in part because earnings growth in the public sector has been weak so far this year, with no growth in pay in the 3rd quarter of 2013 compared with the same quarter a year before. This has led the OBR to reduce its forecast for public sector pay growth in 2013–14 to only 0.5% compared with a forecast of 2.2% in March. It has also reduced its forecast for each year up to 2016–17 compared to the March forecast. This is unlikely to be much different in Scotland because the Scottish Government generally follows the Treasury on pay policy, with the honourable exception of a more positive approach to the living wage.

The IFS analysis also suggests an acceleration of the fall in public sector pay relative to private sector pay by about 8%. This is not driven by a change in the composition of the workforces as public sector workers are still more likely to be highly educated and in professional or similar roles.

The IFS identify some important implications from this analysis. Primarily, that some public sector employers may well find it increasingly difficult to retain and recruit high quality workers. In Scotland, I would add that the ageing public sector workforce will exacerbate these pressures. A secondary point made by the IFS is that measures to mitigate recruitment problems might come at the cost of further job cuts if the budget targets remain at planned levels.

For the UK and Scottish governments squeezing public sector pay has been viewed as a relatively easy way to cut departmental spending. Given the current OBR forecasts, the choices ahead now look rather harder.

Monday, 16 December 2013

Police chair attacks 'arbitrary' police officer target

It would be fair to say that UNISON Scotland hasn't had a lot of good things to say about the Scottish Police Authority. It's nothing personal, but we felt that their role was confused in the legislation and their attempts to take over delivery functions were ill advised. However, in this post I am happy to give credit to the SPA Chair for clearly articulating what everyone in the service knows - Scotland's police should have a balanced workforce, not one driven by a cosmetic police officer target.

Vic Emery, chair of the Scottish Police Authority (SPA), told a Holyrood conference that work was already underway on a scoping exercise to ascertain the number of police officers needed nationwide. A Scottish Government commitment not to let police officer numbers drop below 17,234 is predicated on an “arbitrary” target that needs to be reassessed.

“Over the years I have asked the question – ‘how many cops do we need?’ Senior police colleagues have always been honest enough to say ‘as many as you can give me’. However, I believe there is a general acceptance that there is an arbitrary element to how we have ended up at the figure of 17,234 officers.”

And he is not alone. Police Scotland chief constable Sir Stephen House has previously questioned the long-term sustainability of the target given savings being asked of the single service.

The SPA chair insisted there was a need for a “balanced team” between police officers and police staff a point UNISON has consistently made since the target was announced. This has been reinforced since the creation of a national police force with a major savings target. The consequence has been police officers substituting for police staff at twice the cost while taking them away from operational duties.

Vic Emery also said, “I know that concerns have been raised about decivilianization and what is termed as backfilling. I think both terms are unhelpful because it suggests a huge and clear divide between what is ‘front line’ and ‘back office’. A transformed service means a service with the right people with the right skills and powers in the right places at the right time. The roles that are carried out by police officers and civilians are not etched in stone. They have evolved and will continue to evolve. But any study of the number of police officers we need, must also look at the balance between civilian and uniformed.”

Justice Secretary Kenny MacAskill's defence is that this was a, "mandate we sought re-election for on in 2011 and remain committed to". This ignores the fact that the mandate predates the establishment of a national police force. This is the opportunity to change tack, not least because he, and the SPA, are also required by law to adopt Best Value. That duty trumps daft political posturing.

As the great John Maynard Keynes once said; "When the facts change, I change my mind. What do you do sir?"

Thursday, 12 December 2013

Real wages cut for fifth year in a row

The Annual Survey of Hours and Earnings (ASHE) provides information about the levels, distribution and make-up of earnings and hours worked for employees in all industries and occupations. ASHE is based on a one per cent sample of employee jobs taken from HM Revenue & Customs (HMRC) PAYE records.The provisional 2013 figures have been released today.

The headline is that wages continue to rise slower than inflation, resulting in a further real terms pay cut for workers. Wages went up by 2.2% (slightly less in Scotland at 2.1%) while CPI increased by 2.4%.

However, it's even worse for public sector workers. The median gross weekly pay of full-time employees in the public sector was £574 in April 2013, up 1.6% from £564 in 2012. For the private se

ctor the comparable figure was £490, up 2.3% from £479 in 2012.

Median full-time earnings have now fallen by 6.2% in Scotland since 2010 leaving workers £1753 worse off. The figures also confirm that the bottom two income deciles have seen the biggest real terms falls in earnings since 2010, exacerbating already significant income inequality in Scotland.

The full-time gender pay gap increased to 15.7 per cent in 2013 (up from 14.8 per cent the year before). The voluntary approach to tackling gender pay inequality is clearly failing and tougher action is needed to force companies audit their pay gaps.

And the big winners this year? Farmers, with a 21.8% increase in earnings, followed closely by undertakers at 20.3%. I'll spare you the jokes!

Here is a helpful ONS pictogram to illustrate the UK picture.

Working households lose £1500

Disposable income for working households in Britain has fallen by £1500 in the past two years. The "median equivalised disposable income" for non-retired households fell between 2009/10 and 2011/12 from £27,176 to £25,671, a reduction of £1505.

The latest data on family income and spending from the Office for National Statistics (ONS) shows that since the economic downturn in 2008, median household income for the overall population fell by 3.8%, after adjusting for inflation. The median income for non-retired households fell by 6.4% while that for retired households grew by 5.1%. This is probably due to pensioners receiving benefits such as the annual winter fuel allowance as well as the annual upgrading of state pensions.

If you want to know where your declining cash goes to, here is a grim info graphic from the ONS.

Wednesday, 11 December 2013

A coherent approach to housing taxation

The funding of local government has been a difficult issue for political parties. At best proposals have been sticking plaster solutions because change is viewed as being politically challenging. UNISON Scotland is arguing that we simply cannot go on as we are with short-term fixes that damage services and undermine local democratic accountability. We need to develop a new consensus that provides a long-term solution. To that end we have published a briefing and a discussion paper on a new property tax for Scotland.

The Institute of Fiscal Studies have also recently made a contribution to this debate with a paper, "Housing Taxation and Support for Housing Costs" by Stuart Adam.

He argues that the the UK’s system of housing taxes and benefits falls well short of a coherent design, “housing is a consumption good, an asset and an essential for life, and its treatment in the tax and benefit system needs to reflect all of those aspects.”

These are some of the key reforms he believes would help to improve the system:

Housing consumption should be taxed like other consumption: subject to VAT when new or to an equivalent tax levied on the stream of services it provides. Britain’s council tax, which is currently based on 1991 values in England and Scotland, should be reformed to relate it more closely to actual property values: levied as a uniform proportion of up-to-date rental values with no cap and no discount for unoccupied or single-occupancy properties.

Taxation of rented housing should be reformed by offering landlords an allowance against a ‘normal’ return to their investment (and by aligning capital gains tax rates with income tax rates).

The UK’s stamp duty on housing should be abolished and the revenue replaced by part of the reformed council tax.

There is a case for allowing home-owners who lack the liquidity to pay the tax to defer payment (with interest) until sale of the property or death.

Those who lack both current income and assets should be entitled to financial help towards their housing tax, and indeed towards their housing costs more generally. Preferably this would form part of a larger integrated benefit rather than requiring a separate means test and procedures.

Stuart Adam said: “There is a set of principles for housing taxation that should be applied in any modern economy. Large changes need to be phased in carefully, but this is an area where current UK practice is a long way from an economically rational and efficient system.”

Another fall in new house building

The Scottish Government has published the latest statistics on new house building. It doesn't make happy reading.

Historically, from a high point of about 41,000-43,000 completions a year, mainly in the public sector, the level of new build fell during the Thatcher years to under 20,000 completions per year.

There was then an upward trend which peaked in 2005 at 26,468 completions. However, this trend has since reversed and by March 2013 was 13,803, 48% below the peak in 2004-05.

The number of starts decreased by 9% in the latest year (to 31 March 2013). The latest quarter shows the number of starts decreased by 19% compared to the same quarter in 2012.

There were 1,189 new council houses started in the latest year (to 30 June 2013) and 1,010 were completed. In essence there was a decline in building new social homes, private sector homes and housing association homes at a time when demand in all three sectors has never been higher.

The Scottish Government blamed economic conditions and UK budget cuts. The Opposition blamed the SNP Government. No shock there then!

The SNP Government has cut the capital budget for housing by almost 30% since they came to power in 2007. However, they maintain they're still on track to build 30,000 affordable homes during the lifetime of this Parliament.

Monday, 9 December 2013

How austerity economics is being used to reshape the state

The small print of the autumn statement and OBR forecasts shows how the Chancellor is using austerity economics to reshape the state.

Will Hutton in the Observer notes that the OBR states that by 2018, general government consumption will be proportionally no larger than it was in 1948. As he puts it, "The work of three generations in building the sinews of a state that support systems of health, transport, education, environment, policing, science and the rest is to be summarily withdrawn over the next five years. It is a landmark moment in our national life."

The next stage for the ConDems is to legislate that the reduction of the deficit on this scale and speed should be a statutory obligation. Almost all of the work is to be done by cutting spending, by a cumulative £75bn in ways yet to be specified. There is a token measure on tax avoidance that experts say will leave 99% of tax dodging untouched and the super rich are to get a tax cut.

The IMF, after assessing the experience of 107 countries between 1980 and 2012, recommends that, after a credit-crunch deficit, there should be a balance between tax increases and spending reductions. However, Osborne plans more than 95% to come from spending cuts - with incalculable economic and social harm.

The IFS says that public service cuts will average 2.3% a year between 2011 and 2016 - from 2016 to 2019 they are scheduled to be 3.7%. Put another way, so far the ConDems have cut spending on public services by 8%; by 2018-19 this will have become a cut of 20%.

The OBR report strongly implies that the claimed economic recovery is simply a cyclical snapback of the economy driven by a recovery of demand. Duncan Weldon explains the economics of cyclical and structural deficits at the Touchstone blog. Stephen Boyd has put a number of slides on the STUC Better Way blog that gives a realistic view of the Scottish labour market in this context. As Hutton puts it, "This should not be the excuse to shrug off the calamity of irrational total austerity, and hack away at the state with abandon. But sure enough that is what is now promised".

He goes on to set out the political issues for the Liberal Democrats in particular and the spending consequences for key departments. Hutton also sets out the challenge for Labour who "must be brave enough to set out what kind of state and social settlement they want, and how best to lift the stagnating productivity of British workers, which is at the root of the "cost-of-living crisis". Lib Dems need to ask themselves if they really want to be allies in creating the regressive, punitive civilisation Cameron and Osborne have in mind. Back to 1948? Or onward to something smarter, fairer and more generous? It's decision time."

Indeed it is!

Challenges of locality planning

The Christie Commission supported the idea of drilling down locality planning to 'real' communities below our mainly very large council areas. They saw merit in the English 'Total Place' concept that brought together funding and sought to integrate services at local level.

The Public Bodies (Joint Working) Bill provides, at section 23(3) that strategic plans produced by health and social care partnerships must include provision for dividing the area of the local authority into two or more localities, and setting out separately arrangements for the carrying out of the integration functions in relation to each such locality. This recognises that as with 'Total Place' some aspects of service planning can operate more effectively and efficiently at a more local level than the integration authority itself. No model of locality planning is prescribed in the Bill, as the Scottish Government believes that local arrangements are best developed and agreed upon locally.

The difficulties with locality planning in Scotland's local government structure was highlighted by me and other organisations giving evidence to the Health Committee and this is reflected in the First Stage report, which states:

"The Committee is also fully supportive of the idea of locality planning, which will be essential if services are to redesigned in a bottom-up way that engages individuals and local communities in a flexible way that delivers the best possible outcomes for patients and other service users."

In 2010 the UK Government announced its intention to pilot Community Budgets in England as a method of integrating public services and giving, “local public service partners the freedom to work together to redesign services around the needs of citizens, improving outcomes, reducing duplication and waste and so saving significant sums of public money”

The Westminster, Communities and Local Government Committee has recently looked at this issue and published a report that found:

"that the pilot Community Budgets are already demonstrating, through joint working between agencies and local and central government, the clear potential to facilitate cheaper and more integrated public services. They can also be used to make public services more effective by focusing on the specific needs of local areas and individual service users. However, achieving their full potential will require strong leadership at a local level as well as a commitment from central government to facilitate local partnerships and the flexibilities needed to develop local strategies and solutions to specific local issues."

The report also concludes that:

"Community Budgets have shown the potential to provide for the future development of public services. If not they may simply become the latest ‘shiny new idea’ at risk of being replaced within a few years."

The same could be said about locality planning in Scotland.

The poorest pay the price for austerity economics

Research carried out by the New Economics Foundation for UNISON shows why and how the public sector can lead a shift to progressive employment practices for all public service workers and public sector supply chains. And there is also the prospect not only of benefiting around one million low paid public service employees, but catalysing a wider progressive labour market movement.

Whilst this report has a UK focus it reinforces the arguments we made over the Procurement Reform Bill in the Scottish Parliament last week.

Historically public service employment has played a progressive role, with fairer pay distribution, solidaristic wage bargaining and a track record in progressing gender equality providing an important benchmark for the wider labour market. But now, benchmarking of pay to unregulated norms of wage-cutting in the worst parts of the private sector has embedded a race to the bottom for millions of workers, including in vital public services. As a result nothing less than a counter-cultural response is needed to raise the benchmark to a better standard.

Six key recommendations for public sector action flow from the research:

1. Active support at all levels of government to ensure the living wage is paid by employers across public service supply chains, directly benefiting 1 million public service workers today.

2. Government to lift the pay cap, which has resulted in pay in public services falling by more than £2000 a year on average in real terms since 2010.

3. Policy action by government to establish robust fair wage resolutions determining benchmarks for employment conditions across public service supply chains.

4. Active support by government for collective bargaining of pay and employment standards throughout public service organisations and businesses.

5. Action by policy-makers, commissioners and employers to scrap zero-hours contracts in key sectors such as social care.

6. Implementation of new indicators, such as mandatory reporting of top, middle and bottom pay by employers across public service supply chains.

Austerity economics has resulted in the biggest drop in living standards since Victorian times with low and middle earners suffering an unprecedented squeeze on their incomes. This report shows that there is a better way.

Whilst this report has a UK focus it reinforces the arguments we made over the Procurement Reform Bill in the Scottish Parliament last week.

Historically public service employment has played a progressive role, with fairer pay distribution, solidaristic wage bargaining and a track record in progressing gender equality providing an important benchmark for the wider labour market. But now, benchmarking of pay to unregulated norms of wage-cutting in the worst parts of the private sector has embedded a race to the bottom for millions of workers, including in vital public services. As a result nothing less than a counter-cultural response is needed to raise the benchmark to a better standard.

Six key recommendations for public sector action flow from the research:

1. Active support at all levels of government to ensure the living wage is paid by employers across public service supply chains, directly benefiting 1 million public service workers today.

2. Government to lift the pay cap, which has resulted in pay in public services falling by more than £2000 a year on average in real terms since 2010.

3. Policy action by government to establish robust fair wage resolutions determining benchmarks for employment conditions across public service supply chains.

4. Active support by government for collective bargaining of pay and employment standards throughout public service organisations and businesses.

5. Action by policy-makers, commissioners and employers to scrap zero-hours contracts in key sectors such as social care.

6. Implementation of new indicators, such as mandatory reporting of top, middle and bottom pay by employers across public service supply chains.

Austerity economics has resulted in the biggest drop in living standards since Victorian times with low and middle earners suffering an unprecedented squeeze on their incomes. This report shows that there is a better way.

Thursday, 5 December 2013

UK Autumn Statement - what it means for Scotland

No joy for the workers in today’s Autumn Statement, the very title is a joke given the weather. But then we don’t expect much joy from the shop steward for the super rich.

The small scale fiscal measures play at the fringes of household expenditure and are paid for by other spending cuts – a further 0.2% from the Scottish budget. They do nothing to reverse the diversion of wealth from the bottom and middle to a super rich cabal and company profits. If the economy is now slowly growing, we will not forget that this has been the longest and deepest recession for generations, caused by the Chancellors austerity economics. The delayed proceeds of economic growth have to be shared equally and that means real wages, not tax cuts for the rich.

The STUC summed it up with: “There is nothing today’s statement to help embed the recovery and create decent jobs. While recent growth is largely attributable to consumer spending, real wages continue to fall at rate unprecedented in modern times. Yet the Chancellor brazenly adopted a triumphalist tone just as the Office for Budget Responsibility (OBR) revised down its forecast for wages growth. He continues to ignore the glaring disconnect between growth and living standards.”

This highlights the Office for Budget Responsibility forecasts attached to the Statement. Households are now expected to spend more but earn less than was the case in March. Osborne once promised a ‘new economic model’ built on savings, exports and business investment. As the election draws near, he is returning to the ‘old model’ of consumption and household debt.

On living standards UNISON General Secretary, Dave Prentis, said:

“The Chancellor can produce this mirage of an economic recovery and massage the figures as much as he wants, but it doesn’t mask what is being felt in the real world. Prices have risen faster than wages for 40 out of the 41 months in the past years. Average earnings are £1600 lower in real terms than when they came to power. There has been a massive explosion in the number of people forced to work part-time, on zero hours’ contracts and stuck on low pay.”

UNISON members will be particularly concerned over the bringing forward of the state pension age. The state pension age is already rising to 66 by 2020 and 67 by 2028. It was then expected to go up to 68 between 2044 and 2046. Now that rise to 68 is going to come in earlier - in the mid-2030s - meaning that millions more people will retire later. This change also applies to public sector pension schemes in Scotland as the retirement age is now linked to the state pension age.

This change is entirely cost driven and a particular concern in Scotland with our lower life expectancy. However, I wonder if the Chancellor has done all the calculations as savings in pensions will be offset by higher sick pay, benefits and the cost of early retirement pensions. It is also another unequal measure, as the affluent will still be able to afford to retire early, while the poor work on and die earlier. It could also add to youth unemployment as older workers block young workers getting jobs. This was highlighted in the recent Audit Scotland report on Scotland’s public sector workforce that showed the only workforce age group that is increasing is 50-59yrs, up by 5%.

Scotland will benefit from the Barnett consequentials of the additional funding in England for child care and free school meals. However, the £308m headline is not all recurring revenue spending. It will no doubt spark a debate in the Scottish Parliament over spending priorities. Improved child care now I wonder?

The small scale fiscal measures play at the fringes of household expenditure and are paid for by other spending cuts – a further 0.2% from the Scottish budget. They do nothing to reverse the diversion of wealth from the bottom and middle to a super rich cabal and company profits. If the economy is now slowly growing, we will not forget that this has been the longest and deepest recession for generations, caused by the Chancellors austerity economics. The delayed proceeds of economic growth have to be shared equally and that means real wages, not tax cuts for the rich.

The STUC summed it up with: “There is nothing today’s statement to help embed the recovery and create decent jobs. While recent growth is largely attributable to consumer spending, real wages continue to fall at rate unprecedented in modern times. Yet the Chancellor brazenly adopted a triumphalist tone just as the Office for Budget Responsibility (OBR) revised down its forecast for wages growth. He continues to ignore the glaring disconnect between growth and living standards.”

This highlights the Office for Budget Responsibility forecasts attached to the Statement. Households are now expected to spend more but earn less than was the case in March. Osborne once promised a ‘new economic model’ built on savings, exports and business investment. As the election draws near, he is returning to the ‘old model’ of consumption and household debt.

On living standards UNISON General Secretary, Dave Prentis, said:

“The Chancellor can produce this mirage of an economic recovery and massage the figures as much as he wants, but it doesn’t mask what is being felt in the real world. Prices have risen faster than wages for 40 out of the 41 months in the past years. Average earnings are £1600 lower in real terms than when they came to power. There has been a massive explosion in the number of people forced to work part-time, on zero hours’ contracts and stuck on low pay.”

UNISON members will be particularly concerned over the bringing forward of the state pension age. The state pension age is already rising to 66 by 2020 and 67 by 2028. It was then expected to go up to 68 between 2044 and 2046. Now that rise to 68 is going to come in earlier - in the mid-2030s - meaning that millions more people will retire later. This change also applies to public sector pension schemes in Scotland as the retirement age is now linked to the state pension age.

This change is entirely cost driven and a particular concern in Scotland with our lower life expectancy. However, I wonder if the Chancellor has done all the calculations as savings in pensions will be offset by higher sick pay, benefits and the cost of early retirement pensions. It is also another unequal measure, as the affluent will still be able to afford to retire early, while the poor work on and die earlier. It could also add to youth unemployment as older workers block young workers getting jobs. This was highlighted in the recent Audit Scotland report on Scotland’s public sector workforce that showed the only workforce age group that is increasing is 50-59yrs, up by 5%.

Scotland will benefit from the Barnett consequentials of the additional funding in England for child care and free school meals. However, the £308m headline is not all recurring revenue spending. It will no doubt spark a debate in the Scottish Parliament over spending priorities. Improved child care now I wonder?

Austerity uncovered

On the day of the Chancellor's 'Autumn' Statement (doesn't feel very autumnish!), the TUC has released a film that uncovers the reality behind George Osborne's ideological drive to slash public services.

This video shares some of the stories and experiences they heard on their travels and if one things clear it's that austerity is hurting, but it isn't working.

The TUC has also published a new report 'Is Social Security Spending Really Out Of Control?'. This compares social security spending over the course of this parliament with the UK government’s original forecast in 2010, as well as taking a longer term look at welfare spending over the last three decades. It highlights the rising number of working people living in poverty is causing the government to spend billions more than planned on social security.

The report examines the main areas of social security spending – which is set to be £9.2bn a year more than originally forecast by 2014-15 – and finds that rising in-work poverty, caused by real wage falls and the concentration of new jobs in low paying industries, is the main cause of over-spending.

Monday, 2 December 2013

What Works in local economic growth policy

Understanding and assessing the evidence of what works in delivering better economic outcomes for communities is rarely straightforward. Initiatives are not always properly evaluated and when they are often turn into simple self justification.

The recently established what works centre for local economic growth seeks to change that. The centre, a collaboration between the LSE, the Centre for Cities and Arup, will review policy areas such as employment, skills, housing and regeneration and will provide policymakers with the evidence and insights they need to design and deliver services that will drive local economic growth and employment.

The centre will identify certain local growth policy areas and assess the effectiveness of existing interventions, by ranking them to see how strong the evidence is, how it has been applied, and its cost-effectiveness. Local government is a target audience for this work.

While this project appears to be focusing on England, it has attracted some interest north of the border. It may well have some lessons for Scotland in an area of public policy that has a limited evidence base here as well.

Thursday, 28 November 2013

Councils and poorer communities

The Joseph Rowntree Foundation has published an interim report – Coping with cuts? Local government and poorer communities - that seeks to track the impact of tighter public spending and the state of the economy on poorer people and places.

Local government spending (excluding police, schools, housing benefit) is set to fall by nearly 24% in real terms between 2008 and 2015 in Scotland.

They have found that cuts in spending power and budgeted spend are systematically greater in more deprived local authorities than in more affluent ones. This is mainly because these councils are more grant dependent. In Scotland it means that the West of Scotland councils suffer more than those from the East.

The most deprived Scottish councils reduced expenditure between 2010 and 2013 by £90 per head more than the most affluent councils did. Interestingly, the figures for England are similar, so there is little indication that the Scottish Government is targeting resources any better than the ConDems.

John Low, Policy and Research Manager at JRF, said: “This is an important and very timely report which provides graphic illustrations of how spending cuts are playing out on the ground. As we approach the fourth austerity settlement for local government in December, it is clear the cuts are biting deep into the poorest and most deprived communities. Unless we can muster the national will to correct or mitigate the unacceptable divergence of resources between more and less affluent authorities, we are slowly but inexorably creating a more divided society.”

Local government spending (excluding police, schools, housing benefit) is set to fall by nearly 24% in real terms between 2008 and 2015 in Scotland.

They have found that cuts in spending power and budgeted spend are systematically greater in more deprived local authorities than in more affluent ones. This is mainly because these councils are more grant dependent. In Scotland it means that the West of Scotland councils suffer more than those from the East.

The most deprived Scottish councils reduced expenditure between 2010 and 2013 by £90 per head more than the most affluent councils did. Interestingly, the figures for England are similar, so there is little indication that the Scottish Government is targeting resources any better than the ConDems.

John Low, Policy and Research Manager at JRF, said: “This is an important and very timely report which provides graphic illustrations of how spending cuts are playing out on the ground. As we approach the fourth austerity settlement for local government in December, it is clear the cuts are biting deep into the poorest and most deprived communities. Unless we can muster the national will to correct or mitigate the unacceptable divergence of resources between more and less affluent authorities, we are slowly but inexorably creating a more divided society.”

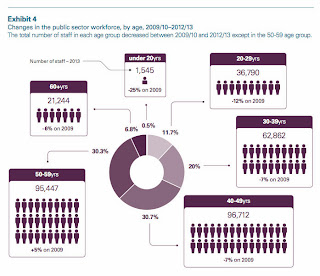

Scotland's public sector workforce

Today’s Audit Scotland’s report on the public sector

workforce shows clearly how it’s the workforce that have taken the brunt of

spending cuts.

It shows that staff costs have been cut by over £1bn between

2009/10 and 2011/12. And that doesn’t include the savings from pay restraint.

26,600 whole time equivalent (WTE) posts were cut between

March 2009 and March 2013 (7%). Some 9,665 were transferred to arms length

bodies outside the public sector. 15,816 WTE left through early departure schemes,

although these have been reducing in recent years. Councils made the biggest reduction (10%)

while the NHS had the smallest cut (1%).

The report, if anything, understates the picture because the

numbers are converted into WTE. In terms of real people (headcount), 48,700

have gone (excluding the financial sector) since the height of public sector

employment just before the financial crash - 5,500 people in the last year

alone.

Given the scale of early departure schemes it might be

expected that the numbers of older staff would be reducing. However, the report

shows that the only age group that is increasing is 50-59yrs, up by 5%.

Probably due to recruitment freezes the numbers of younger workers are falling.

The chart below illustrates this change.

The report sets out the range of methods used by public

bodies to reduce workforce costs with pay restrictions, vacancy management and

early retirement the most common. More than a third of councils used compulsory

redundancy. There is some criticism of the level of evaluation of early

departure schemes.

Future workforce changes are inevitable given the budget

cuts to come. The report outlines a range of ways this might be achieved,

including considering service delivery cuts. The report recommends better

national and local workforce planning.

Overall, the report is a useful description of what has

happened to the public service workforce in Scotland. The recommendations are

largely sensible, but little more than a sticking plaster over the impact of spending

cuts to come.

Tuesday, 26 November 2013

Fat cats are driving inflation up

Richard Lynch in today’s Morning Star reminds us that we now have the highest inflation in the European Union and that recently announced price rises for gas, electricity, rail fares and other necessities will soon drive inflation figures up again. This will have serious consequences for UNISON members suffering from pay restraint.

He compares in detail price increases in the UK compared to our European neighbors. A look at our nearest neighbor Ireland is interesting.

“Food and drink prices increased by 35.6 per cent in Britain over the six year period, while prices in Ireland increased by only 1 per cent. Gas and electricity prices increased by 61 per cent here while prices in Ireland increased by a much lower 28 per cent. Overall inflation increased by 20.7 per cent here while Irish inflation increased by only 3.2 per cent.”

Richard then goes on to ask why is inflation so much higher in this country than in other comparable nations?

It is clearly not wages or exchange rates. He argues that it is big companies who are pushing up their prices to boost their already high profits and to give their fat-cat executives lavish remuneration packages. Outsourcing and VAT increases add to this. He concludes:

“Not only are we being fleeced by inflation, we are being taken for fools by the people who are creating it so that they can transfer cash from our pockets to theirs and increase inequality in income and wealth even further.”

He compares in detail price increases in the UK compared to our European neighbors. A look at our nearest neighbor Ireland is interesting.

“Food and drink prices increased by 35.6 per cent in Britain over the six year period, while prices in Ireland increased by only 1 per cent. Gas and electricity prices increased by 61 per cent here while prices in Ireland increased by a much lower 28 per cent. Overall inflation increased by 20.7 per cent here while Irish inflation increased by only 3.2 per cent.”

Richard then goes on to ask why is inflation so much higher in this country than in other comparable nations?

It is clearly not wages or exchange rates. He argues that it is big companies who are pushing up their prices to boost their already high profits and to give their fat-cat executives lavish remuneration packages. Outsourcing and VAT increases add to this. He concludes:

“Not only are we being fleeced by inflation, we are being taken for fools by the people who are creating it so that they can transfer cash from our pockets to theirs and increase inequality in income and wealth even further.”

Monday, 25 November 2013

Bonus culture short changes investment and pay

A key feature of UNISON’s case for fair pay is the wider economic benefit. We have highlighted the shift from wages into profits that reduce demand in the economy and are a large cause of the slow recovery from recession. We also argue that the rich spend less of their additional income, whereas low paid workers spend more in the local economy.

Duncan Weldon at the TUC has usefully summarised a range of evidence supporting this view from recent economic blogs. One paragraph from the Flip Chart Fairy Tales blog concisely makes the key historical point:

“the corporate executives of the early postwar world paid their workers high wages. This increased demand and fuelled growth but also meant that companies needed to invest. After the 1980s, executives began to take a much greater share of wealth out of their companies. They then lent it, through the burgeoning financial services industry, to their now much lower paid workers. The debt based consumption filled the gap left by the wage-based consumption of earlier years. Or, at least, it used to. What started in the 1980s as an assertion of management’s right to manage and a repudiation of the collectivist corporatism of the 1970s has resulted in a wealth imbalance that may have disastrous and long-lasting economic consequences.”

Charts in this blog show how investment has declined as well as wages on the altar of profit. This is important because many on the right argue that profit is necessary to fund investment.

This means that the way executives are rewarded, with huge bonuses linked to share prices, has encouraged short-termism and the extraction of large profits at the expense of investment. At the same time, the weakening of unions and worker bargaining power has enabled them to get away with it and has created a market for rising credit. Executive reward and corporate behaviour has therefore been a major factor leading to an economic stagnation that may last for years.

Duncan Weldon at the TUC has usefully summarised a range of evidence supporting this view from recent economic blogs. One paragraph from the Flip Chart Fairy Tales blog concisely makes the key historical point:

“the corporate executives of the early postwar world paid their workers high wages. This increased demand and fuelled growth but also meant that companies needed to invest. After the 1980s, executives began to take a much greater share of wealth out of their companies. They then lent it, through the burgeoning financial services industry, to their now much lower paid workers. The debt based consumption filled the gap left by the wage-based consumption of earlier years. Or, at least, it used to. What started in the 1980s as an assertion of management’s right to manage and a repudiation of the collectivist corporatism of the 1970s has resulted in a wealth imbalance that may have disastrous and long-lasting economic consequences.”

Charts in this blog show how investment has declined as well as wages on the altar of profit. This is important because many on the right argue that profit is necessary to fund investment.

This means that the way executives are rewarded, with huge bonuses linked to share prices, has encouraged short-termism and the extraction of large profits at the expense of investment. At the same time, the weakening of unions and worker bargaining power has enabled them to get away with it and has created a market for rising credit. Executive reward and corporate behaviour has therefore been a major factor leading to an economic stagnation that may last for years.

Friday, 22 November 2013

No more NEETs

The IPPR has published a paper that sets out a strategy for radically increasing the proportion of young people who are learning or earning, by establishing a distinct work, training and benefits track for those aged 18–24. This approach is underpinned by two new initiatives: a youth allowance, to keep young people out of the adult welfare system, and a youth guarantee, to ensure they stay in touch with the labour market.

There are over a million young people who are not in education, employment or training (NEET) in the UK, equivalent to almost a fifth of all 18–24-year-olds. Just 4% of 15–24-year-olds in the Netherlands and 7% in Denmark are NEET, compared to 14% in the UK. This is a huge waste of individual potential and imposes large, long-term costs on society.

There are three key planks to the plan:

1. A youth allowance should replace existing out-of-work benefits for 18–24-year-olds and provide financial support for young people who need it, conditional on participation in purposeful training or intensive job-search. Access to inactive benefits should be closed off for all but a very small minority. To pay for this substantial expansion of financial support for young people who are currently NEET or in further education, the youth allowance should be paid at a standard rate and be means tested on the basis of parental income until the young person is over the age of 21. This would mirror the rules for access to the higher education maintenance grant. There should also be a presumption that young people are housed by their parents until they are over 21, with exceptions for those with a child, a disability or in employment.

2. A youth guarantee should be established that offers young people access to further education or vocational training plus intensive support to find work or an apprenticeship. For those not learning or earning after six months, paid work experience and traineeships should be provided, with no option to refuse and continue receiving the youth allowance. The youth guarantee would ensure that young people can complete their initial education and gain practical employability skills, while not drifting into inactivity. To pay for this substantial expansion of provision for young people, expenditure on 18–24-year-olds in the Work Programme should be re-directed, along with adult skills and apprenticeship funding for over-24s. In addition, parents’ entitlement to child benefit and child tax credit should cease at the end of the school year after their child has turned 18, when their entitlement to youth allowance begins.

3. The government should set national objectives and priorities for the youth guarantee, but the leadership of local areas should be mobilised to organise and deliver it. Decentralisation should start with London and the eight ‘core cities’ in England taking on resources and responsibility for their young people. These cities should establish strong governance arrangements, including a central role for employers, along with plans for commissioning a diverse network of local providers. In other parts of England the youth guarantee should be commissioned nationally and delivered through existing agencies and providers (with local input wherever possible). In every area, the personal adviser model should be paramount and data on performance against headline national objectives should be regularly published. To increase opportunity and drive employer engagement, large firms that do not offer apprenticeships for young people should pay a ‘youth levy’ to train and prepare the future workforce.

There are devolved aspects of this plan that would need to be agreed by the Scottish Parliament. It also fits in well with suggestions that Scotland’s cities should take responsibility for welfare to work programmes.

There are over a million young people who are not in education, employment or training (NEET) in the UK, equivalent to almost a fifth of all 18–24-year-olds. Just 4% of 15–24-year-olds in the Netherlands and 7% in Denmark are NEET, compared to 14% in the UK. This is a huge waste of individual potential and imposes large, long-term costs on society.

There are three key planks to the plan:

1. A youth allowance should replace existing out-of-work benefits for 18–24-year-olds and provide financial support for young people who need it, conditional on participation in purposeful training or intensive job-search. Access to inactive benefits should be closed off for all but a very small minority. To pay for this substantial expansion of financial support for young people who are currently NEET or in further education, the youth allowance should be paid at a standard rate and be means tested on the basis of parental income until the young person is over the age of 21. This would mirror the rules for access to the higher education maintenance grant. There should also be a presumption that young people are housed by their parents until they are over 21, with exceptions for those with a child, a disability or in employment.

2. A youth guarantee should be established that offers young people access to further education or vocational training plus intensive support to find work or an apprenticeship. For those not learning or earning after six months, paid work experience and traineeships should be provided, with no option to refuse and continue receiving the youth allowance. The youth guarantee would ensure that young people can complete their initial education and gain practical employability skills, while not drifting into inactivity. To pay for this substantial expansion of provision for young people, expenditure on 18–24-year-olds in the Work Programme should be re-directed, along with adult skills and apprenticeship funding for over-24s. In addition, parents’ entitlement to child benefit and child tax credit should cease at the end of the school year after their child has turned 18, when their entitlement to youth allowance begins.

3. The government should set national objectives and priorities for the youth guarantee, but the leadership of local areas should be mobilised to organise and deliver it. Decentralisation should start with London and the eight ‘core cities’ in England taking on resources and responsibility for their young people. These cities should establish strong governance arrangements, including a central role for employers, along with plans for commissioning a diverse network of local providers. In other parts of England the youth guarantee should be commissioned nationally and delivered through existing agencies and providers (with local input wherever possible). In every area, the personal adviser model should be paramount and data on performance against headline national objectives should be regularly published. To increase opportunity and drive employer engagement, large firms that do not offer apprenticeships for young people should pay a ‘youth levy’ to train and prepare the future workforce.

There are devolved aspects of this plan that would need to be agreed by the Scottish Parliament. It also fits in well with suggestions that Scotland’s cities should take responsibility for welfare to work programmes.

How companies make money from forced labour

New research from the Joseph Rowntree Foundation adds timely evidence to current debates on forced labour and modern day slavery in the UK. This has been highlighted in debates at UNISON's Scottish Council and by service groups.

The research analyses how different types of UK industries make money from forced labour, this study finds that:

• How the UK economy functions creates a pool of people who are vulnerable to forced labour. People who are excluded from formal work (by policy or practice) and those in jobs at or near minimum wage levels are most susceptible to forced labour.

• Forced labour is used when it makes business sense to do so, and is strongly associated with informality in the labour market (which takes different forms in different sectors).

• Sector-specific conditions that allow for the possibility of forced labour include:

–– illegality of the product (cannabis);

–– volatility and self-regulation of labour providers (construction industry); and

–– seasonality (food sector).

Current approaches are limited in their effectiveness to prevent, detect or prosecute offences. Industry self-regulation (in some sectors of the economy) and inadequate enforcement of labour standards appears to create a sense of impunity among employers. The researchers recommend a multi-stakeholder action plan to co-ordinate activities that price and regulate forced labour out of the UK.

The research analyses how different types of UK industries make money from forced labour, this study finds that:

• How the UK economy functions creates a pool of people who are vulnerable to forced labour. People who are excluded from formal work (by policy or practice) and those in jobs at or near minimum wage levels are most susceptible to forced labour.

• Forced labour is used when it makes business sense to do so, and is strongly associated with informality in the labour market (which takes different forms in different sectors).

• Sector-specific conditions that allow for the possibility of forced labour include:

–– illegality of the product (cannabis);

–– volatility and self-regulation of labour providers (construction industry); and

–– seasonality (food sector).

Current approaches are limited in their effectiveness to prevent, detect or prosecute offences. Industry self-regulation (in some sectors of the economy) and inadequate enforcement of labour standards appears to create a sense of impunity among employers. The researchers recommend a multi-stakeholder action plan to co-ordinate activities that price and regulate forced labour out of the UK.

Tuesday, 19 November 2013

Latest Census Results

The latest report from the 2011 is now available. This report focuses on education and the labour market in Scotland. While some argue that there are more up to date statistics,the point about the census is that everyone is surveyed at the same time. The return rate is very high. In fact it's an offence not to take part. The breadth of data and the ability to cross reference each question to the other questions means there is no better source for information on Scotland's people and their lives. Key findings:

A massive 27% of people living in Scotland have no qualifications, 1% more than the proportion that has degrees or equivalent. Another reason not to cut further education budgets.

Gender segregation in the workplace continues with women making up the vast majority of workers in caring, leisure and administrative and secretarial jobs.

While more people are working, partly because there are more people, there is also a growth in part-time workers: 530,000 people now work part-time. Almost five times more women than men work part-time.

Key categories in this report are:

Qualifications

Economic activity

Hours worked

Unemployment

Industry and occupation

Socio-economic classification (class)

These are all broken down by gender, age and local authority area. All really useful information for local campaigning.

Census reports are a vital source of information and the latest report will be poured over by a range of researchers, policy makers and planners. It is the key tool for planning future public services. How many schools, nurses, roads, and houses will we need? The data also forms the basis for ensuring that all other surveys are of groups that are representative of the wider population. So when you see a spat about whether surveys are worth believing, this is how you would check.

Significantly the UK government is planning to get rid of the census, another victim of their slash and burn of public services. Danny Dorling lays out here why cancelling the census is stupid. A report will go the Scottish government in 2015 let’s hope they decide to reject the UK government’s decision and carry on with a full Scottish Census.

A massive 27% of people living in Scotland have no qualifications, 1% more than the proportion that has degrees or equivalent. Another reason not to cut further education budgets.

Gender segregation in the workplace continues with women making up the vast majority of workers in caring, leisure and administrative and secretarial jobs.

While more people are working, partly because there are more people, there is also a growth in part-time workers: 530,000 people now work part-time. Almost five times more women than men work part-time.

Key categories in this report are:

Qualifications

Economic activity

Hours worked

Unemployment

Industry and occupation

Socio-economic classification (class)

These are all broken down by gender, age and local authority area. All really useful information for local campaigning.

Census reports are a vital source of information and the latest report will be poured over by a range of researchers, policy makers and planners. It is the key tool for planning future public services. How many schools, nurses, roads, and houses will we need? The data also forms the basis for ensuring that all other surveys are of groups that are representative of the wider population. So when you see a spat about whether surveys are worth believing, this is how you would check.

Significantly the UK government is planning to get rid of the census, another victim of their slash and burn of public services. Danny Dorling lays out here why cancelling the census is stupid. A report will go the Scottish government in 2015 let’s hope they decide to reject the UK government’s decision and carry on with a full Scottish Census.

Monday, 18 November 2013

The enabling state - lessons from case studies

The Carnegie Trust have published a series of case studies to illustrate what they see as shift in public service reform from the top down state to the enabling state. They identify different language and approaches in the nations of the UK, albeit with some common themes. Four of the case studies are from Scotland and the project leader is Sir John Eldridge, former head of the civil service in Scotland.

The features of the enabling state include a shift:

• From new public management to public value

• From centralised management to localism

• Fromrepresentativetoparticipativedemocracy

• From silos and towards integration

• Fromacuteinterventiontoprevention

• From recipients to co-producers

• From state delivery to the third sector

The report highlights some themes from the case studies.

The language of co-production and asset based approaches is widely used in discussions about public service reform in Scotland. However, as these case studies show, in practice it can describe a range of different approaches. While there is broad agreement that these models can make a contribution to better service delivery, there is always a risk that inappropriate services are shoe horned into this approach. A new form of the 'one size fits all' ideology. This report is therefore a useful contribution to the debate, with all the caveats that limited case studies have for broader application.

The features of the enabling state include a shift:

• From new public management to public value

• From centralised management to localism

• Fromrepresentativetoparticipativedemocracy

• From silos and towards integration

• Fromacuteinterventiontoprevention

• From recipients to co-producers

• From state delivery to the third sector

The report highlights some themes from the case studies.

- They recognise that creating an enabling environment is not an easy task for government. A state that is too directive in its approach risks failing to make best use of existing individual and community strengths at the local level. On the other hand, a ‘hollow’ state that simply withdraws and leaves communities to ‘get on with it’ risks exacerbating inequalities.

- There is a risk that communities with limited connections within their communities and to professionals and influential people or organisations are left behind. This has been a feature of many community based approaches in Scotland. Almost all of the case studies where co-production occurred operated on a voluntary basis.

- Equally there are a number of barriers to transformational change as 'tinkering around the edges' or incremental change is seen as less effective. These barriers can include existing structures and cultures.

- The case studies emphasised the length of time required for development and implementation. Investing in enough staff with the right mix of skills, experience and personal attributes is vital.

The language of co-production and asset based approaches is widely used in discussions about public service reform in Scotland. However, as these case studies show, in practice it can describe a range of different approaches. While there is broad agreement that these models can make a contribution to better service delivery, there is always a risk that inappropriate services are shoe horned into this approach. A new form of the 'one size fits all' ideology. This report is therefore a useful contribution to the debate, with all the caveats that limited case studies have for broader application.

Fat cats getting fatter

The latest IDS report shows that top Directors earnings increased by 14% in the last year while average earnings fell in real terms. The CBI has been noticeably quiet today about the need for public sector pay restraint!

The big increase came with a 58% rise in the value of vested long-term incentive plans (LTIPs) – share-based schemes linked to shareholder returns, but even basic pay increased by 4%. In contrast, average earnings across all sectors grew by 2.1% and have fallen in real terms for most of the past five years. Even more so in the public sector.

The median salary was £568,500, annual bonus £553,200 and vested LTIP awards £1.2bn. However, most listed companies’ annual accounts do not include vested share awards in the main table detailing with directors’ pay, making it difficult to spot. That will change with new reporting requirements.

Frances O’Grady, General Secretary of the TUC, said: “It’s one thing replacing bonuses with long-term incentive plans, but FTSE 100 companies are simply exploiting this change to make their fat cats even fatter. The time has come for legislation to put ordinary workers on the pay committees of companies. This is the only way to bring some sanity to the way in which directors are paid.”

The big increase came with a 58% rise in the value of vested long-term incentive plans (LTIPs) – share-based schemes linked to shareholder returns, but even basic pay increased by 4%. In contrast, average earnings across all sectors grew by 2.1% and have fallen in real terms for most of the past five years. Even more so in the public sector.

The median salary was £568,500, annual bonus £553,200 and vested LTIP awards £1.2bn. However, most listed companies’ annual accounts do not include vested share awards in the main table detailing with directors’ pay, making it difficult to spot. That will change with new reporting requirements.

Frances O’Grady, General Secretary of the TUC, said: “It’s one thing replacing bonuses with long-term incentive plans, but FTSE 100 companies are simply exploiting this change to make their fat cats even fatter. The time has come for legislation to put ordinary workers on the pay committees of companies. This is the only way to bring some sanity to the way in which directors are paid.”

Thursday, 14 November 2013

Police centralisation process criticised by Audit Scotland

Today’s Audit

Scotland report finds that the Scottish Police Authority and Police Scotland

face continuing challenges in delivering the savings required. In particular, their

limited flexibility in managing police officer and staff numbers. That’s polite

auditor criticism of the political police officer target imposed on Police

Scotland.

The report also

confirms some key UNISON criticisms of the process leading up to the

centralisation of Scotland’s police forces. In particular, that the savings

estimates were based on an Outline Business Case that has never been updated or

moved on to a Full Business Case.

“Both KPMG and PwC highlighted significant

concerns

about financial management in addition to the issues identified by the gateway

reviews.

A number of recommendations from these reviews were not fully

implemented, including the gateway review recommendation to update and use the

business case to test the validity and realism of programme assumptions.”

In addition, the

report highlights the confusion over the roles of the SPA and Police Scotland -

a confusion that was played out in public over many months. UNISON Scotland

drew attention to the potential for conflict, given the lack of clarity, while

the Bill progressed through Parliament.

The report says:

“There

were a number of areas of tension, including:

· different interpretations of the Act, the

Scottish Government’s intention behind the Act, and what this meant for the

role of the SPA in terms of ‘maintaining’ the police service

· the lack of good baseline information on

non-operational police activity; in particular, the lack of comprehensive

financial information to identify how savings outlined in the OBC would be

achieved

· a lack of shared understanding and expectations

over what effective scrutiny of the police service looked like in practice

· the Scottish Government’s changing position over

the way the SPA should operate.”

The report goes on

to express concern that a number of governance issues still need to be

progressed.

This report

articulates what everyone close to the process knows. This was a badly planned

and rushed centralisation of a vital public service, with flawed legislation

and a confused governance structure. The estimated savings were optimistic and

more importantly, not worked up in sufficient detail. Add to all that political

targets on police officer numbers that makes a nonsense of the statutory duty

of Best Value.

Huge challenges

remain, but even at this stage it would help if the Scottish Government stopped

its political interference and allowed Police Scotland to adopt a balanced

workforce.

Wednesday, 13 November 2013

What policy changes do families need in post-crash Britain?

A new briefing from IPPR explores the central problems and

anxieties affecting families across Britain today. The first of their

‘Condition of Britain’ papers.

They highlight five main areas of concern:

·

Financial pressures caused by poor growth in

real wages and price increases on essentials like energy, food, fares and

childcare.

·

Finding time for each other due to long working

hours and poor family leave policies.

·

Money and domestic responsibilities put pressure

on relationships leading to higher rates of divorce and separation.

Geographical mobility weakens family support mechanisms.

·

Parents do a good job, but need support. Stress

and poor mental health is on the increase.

·

Certain markets intrude into family life skewing

children’s priorities towards material goods and away from quality

relationships.

The paper then sets out some lessons for policy and action.

These include:

·

The importance of a decent income, not just

benefits.

·

Strong relationships matter and this means more

than just a tax break for married couples.

·

Parents need practical help, not isolation or

blame.

·

We need strong families who are able to stand up

to market pressure.

This is a really useful contribution to the debate about the

pressures and support families need.

Subscribe to:

Posts (Atom)