The funding of local government in Scotland has been a difficult issue for political parties. At best proposals have been sticking plaster solutions because change is viewed as being politically challenging. However, we simply cannot go on as we are with short-term fixes that damage services and undermine local democratic accountability.

Today, I was giving evidence to the Commission on Local Tax Reform, a welcome cross party initiative co-chaired by the local government minister and the President of CoSLA.

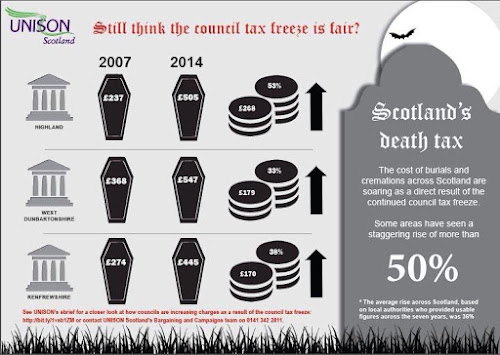

In our submission we cover the piecemeal attempts at reform and highlight the damage that quick fixes like the Council Tax freeze are doing to local services. Increasing charges is a regressive substitute for progressive taxation.

A core element of our case for reform is that property is a significant form of wealth and must be taxed in order to reduce inequality. The well-off already own bigger and more houses than the rest of us. If this form of wealth is untaxed it becomes an even more attractive form of investment. This means that more people buy houses, not as a place to live but as an investment. This will add to our already dire housing shortages, increasing prices for both renters and ordinary buyers.

We set out five principles for reform:

• Local authorities should raise and control more of their own revenue. This will enable them to respond to and be more accountable to the communities they represent. About 85% of funding is currently determined centrally

• Councils should be able to set their own business rates, this will allow them to raise money to pay for services and devise their own criteria to support the type of businesses they want to encourage.

• A property tax is the best fit for local government as it is clearly linked to the authority. It cannot be moved or hidden making it cheap and easy for the local authority to administer.

• Central government funding should acknowledge local decision making and funds should be minimally ring-fenced.

Taxation should be broadly progressive, reducing the tax incidence of people with a lower ability-to-pay. It doesn't mean every tax has to be progressive, but overall, those on higher incomes should pay more.

Our submission also evaluates the options for reform.

We oppose a Local Income Tax primarily because it would be another tax on workers income and ignores the wealth that resides in property. It would have to be administered and set centrally, undermining local democracy. There are also a range of practical problems in collecting and allocating a national tax to local authority areas. It could add as much as 6p to income tax.

Land Value Tax is a superficially attractive option, not least because it is a property tax and might be progressive in taxing the rich. However, this idea has been around for 150 years and their are good practical reasons why it really hasn't taken off. The biggest problem is valuing land while ignoring what is built on it. Most of us have a vague idea what our house is worth, but not a clue of the land value. In order to send out bills and ensure they are paid you also need to know exactly who owns all the land, where the borders are and where to send the bill to. The Scottish Government is working on a register of landowners but has a timescale of ten years to complete this work. We cannot wait at least another ten years for a new tax. If LVT is part of the solution it is as a central tax that could address issues like land banking, or possibly as a replacement for business rates, but not the Council Tax.

That leaves our preferred option of a Local Property Tax levied on a percentage of actual property values. The Burt Review found that using actual property values rather than banding was more progressive because it would get rid of the ‘cliff edge' where those on either side of a band with a small difference in property values have very different bills. On the other hand banding could reduce appeals. In 2007 he recommended it be set at 1% for same yield as the Council Tax and while this would have created one-third losers, half would be gainers. Any future bills must based on up to date property valuations and regular revaluations to prevent the current situation building up again.

The new tax would need to have effective mechanisms to protect those on low incomes. Exempting properties below a certain value is one possible way to do this as is the introduction of an appropriate benefit to ensure local authorities received funding, but still protects those on lower wages/benefits. Pensioners with high value properties and low incomes should also be allowed to defer payments, leaving a bill to be paid which would come out of their estate.

Local taxation is one of the most difficult problems for the Scottish Parliament to resolve. No one party wants to be responsible for a new tax. No one wants to pay higher bills, particularly when real wages are not increasing and other costs are rising. Those who get higher bills will campaign loudly against them, winners will quietly carry on.

Difficult though it is, we cannot continue like this. The Burt Report was essentially a technical report and of its time. This Commission needs to be much more political, making the case for taxation and local democracy. That's why we welcome this Commission and hope it leads to a political consensus that we can all move ahead with.