The long awaited Barclay review of business rates hasn't exactly set the heather alight, but its recommendations are, in the main, pretty sensible.

The reviews main recommendations are set out in this helpful infographic.

The remit for the review was that the recommendations had to be revenue neutral. This means there are gainers and losers from the changes in both the structure and the reliefs.

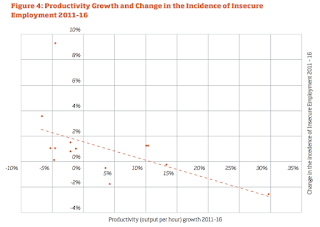

The business lobby has long argued that business rates are too high in Scotland. However, they conveniently ignore the wider picture of business taxation. As this chart shows, businesses generally pay less taxation than their OECD counterparts.

The report recommends a number of administrative improvements such as three yearly revaluations. This is something UNISON has long argued for and the same should apply to the council tax on domestic properties. Better information, transparency and speeding up appeals and repayments are all reasonable. Plugging the many tax loopholes and a general anti-avoidance rule is a long overdue reform.

Big companies have obviously lobbied for consistency, but while the report supports standardisation, it doesn't recommend centralisation through another quango. This should remain a local system, reflecting local knowledge and that fact that most businesses in Scotland are local. The disappointment is that the review should have gone one stage further and returned the decision making on the level of business rates to councils.

The review also questions the effectiveness of the Small Business Bonus Scheme. The government has thrown huge sums of money at this scheme that could have gone into councils. A review in Northern Ireland has found that this relief could be better directed. Reform would also pay for the generous recommended changes in business support costing £45m.

There are winners and losers of reliefs. Town centres and day nurseries get new relief from business rates. It is perfectly reasonable to use tax reliefs to encourage particular policies and early years provision is a key element of tackling inequality. However, such support should come with at least some strings. The Scottish Living Wage would be a good start for the notoriously poor employment practices in many day nurseries.

The losers come in recommendations to restrict charitable relief. Private schools have come out with a predictable defence of their status. However, it’s not the purpose of charitable status to perpetuate the inequalities in our society that private schools sustain.

The other is sport and leisure facilities including council leisure trusts. Despite the claimed benefits of these organisations, the primary driver was tax dodging. If this loophole is plugged, as we warned it might, then councils should be taking these services back under direct control. However, this was one of the ways that councils coped with cuts to their budgets, therefore there would need to be compensatory budget uplift from the Scottish Government.

Supporters of Land Value Tax won't be pleased with the review, even if the door is partly ajar. They came to “An over-arching conclusion that we reached is that some form of property tax is still an appropriate way to fund the local services provided by councils”. While there may be a role for Land Value Tax as part of a basket of taxation, this is the right call.

Finally, the impact of the council tax freeze is highlighted in the revenue data. This chart shows how the council tax and business rates used to raise similar levels of revenue. Hopefully, ending the freeze will start to redress this imbalance once again.

While I might have wished for something a bit more radical, the review overall recommends some pretty sensible reforms. Not without some political challenges for the finance minister!