If you read anything about pensions this year, you should include the recently published Financial Conduct Authority (FCA) interim report on the asset management market. It may not be the easiest read, but it shines a light on why we get such poor value for money from our pensions in the UK.

OK, I don’t expect you to read all 206 pages! There is an executive summary. It should certainly be required reading for pension trustees and in the SLGPS, pension board and committee members. It confirms what UNISON has been shouting about for some time – we need much greater transparency over the real cost of using investment managers.

The UK’s asset management industry is massive. It manages £6.9 trillion of assets. Over £1 trillion for individual investors in the UK and £3 trillion on behalf of UK pension funds and other institutional investors. The service offered to investors comprises a search for return, risk management and administration – although it is the investor that bears virtually all the risk.

Over three quarters of UK households with occupational or personal pensions use these services, including over 10.2 million saving for their retirement through pension schemes. There are also around 11 million savers with investment products such as stocks and shares ISAs.

There will be very few UNISON members who are not touched by this industry, although most will probably have never heard of it. More importantly, they will have little idea how much of their hard earned cash goes to the industry. The report states that asset management firms have consistently earned substantial profits with an average profit margin of 36%! These margins are even higher if the profit sharing element of staff remuneration is included. The saying ‘we are in the wrong job’ has a whole new meaning!

On transparency of costs the report states that investors are not given information on transaction costs in advance. These costs can be high and add around 50 basis points on average to the cost of active management for equity investments. The report says:

“In addition, we have concerns about how asset managers communicate their objectives and outcomes to investors. Investors may continue to invest in expensive actively managed funds which mirror the performance of the market because fund managers do not adequately explain the fund’s investment strategy and charges.”

This is something the LGPS has been addressing through its transparency code and the Scottish LGPS has issued guidance to funds in Scotland to adopt the code. However, its still only voluntary at present and measurable outcomes are some way ahead. The drive for transparency is not as present on the retail side with only half of investors even aware if they are paying charges.

One of my colleagues likes to illustrate this issue using a fridge analogy. If you buy a fridge you can compare the marked price. But the real comparison should include, energy use, delivery charges, warranties and much more. Very few of these charges are transparent when it comes to asset management.

More of us will be familiar with the investment disclaimer, "past performance is no guarantee of future returns". The FCA report highlights the reasons for this. Funds measure performance over different time periods and there is a practice of merging poorly performing funds, “giving investors the false impression that there are few poorly performing funds on the market”. Even those who do outperform don’t continue to outperform the relevant market index or peer group for more than a few years.

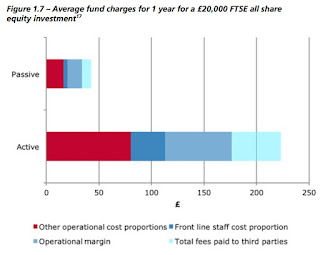

Pension trustees are often sold active investment strategies on the grounds that they deliver higher returns than passive funds that track an index. In the UK the split is around 20% passive to 80% active, whereas in the USA the split is closer to 50:50. However, the evidence in the FCA report suggests that actively managed investments do not outperform their benchmark after costs. And the costs of active investments are significantly higher than passive investments as this chart from the report shows.

Charges have also have remained stable, unlike charges for passive investments, which have been falling. The FCA suggests that this reflects competitive pressures and unwillingness in the active fund market to undercut each other. Weak pressure on prices can lead to weak cost control.

The FCA report is particularly scathing about the role of investment consultants, with 60% of the market controlled by three firms. For example, they found that investment consultants accept hospitality from asset managers, suggesting a further conflict of interest and could result in poor outcomes for end investors. They are considering a market investigation reference to the Competition and Markets Authority (CMA).

The report concludes with a number of very welcome interim proposals on remedies – not least on transparency and all-in fees. However, this is a hugely powerful and profitable industry and they will be lobbying hard to water down any action. It’s up to us to reclaim our pension funds for the workers who rely on them.

No comments:

Post a Comment