We understand that the Council Tax is a difficult issue for politicians, but this latest sticking plaster isn't the solution.

I was giving evidence to the Scottish Parliament’s Local Government Committee this morning on the secondary legislation implementing the Scottish Government’s latest tweak to the Council Tax. These involve increasing the higher bands, ending the freeze and changes to the reduction scheme. More details in my briefing.

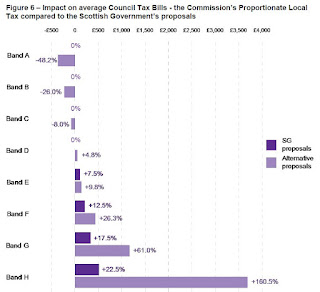

Increasing the multipliers for the top bands is a modest progressive move. However, it still leaves those in a £212,001 home paying the same bill as those in a million pound one. The Commission on Local Tax Reform indicated that the tax on highest value homes would need to be 15 times that of the lowest value homes in order to achieve proportionality. The current system means a £400K house pays three times as much as a £40K house - not ten times. This means that like VAT, it takes up a bigger proportion of low income households than high.

This chart compares the impact of the Commission’s proposals with the Scottish Government’s plan.

The government also needs to clarify how it expects water charges to be treated under the new bands.

In addition, there is to be no revaluation, so the new bandings will be based on 1991 property values. That simply isn’t credible when 57% of properties are in the wrong band. No one doubts that revaluation is politically challenging, even if there are likely to be equal numbers of gainers and losers. It could also introduce transitional provisions. The question is, just how long does the government intend to avoid revaluation before biting the bullet?

A bigger problem is that the Scottish government has decided to take the additional revenues, estimated at £100m, to allocate to their priorities – a new form of ring-fencing. Similarly, they have capped increases to the Council Tax at 3%. Both of these measures undermine local democracy.

Any improvements in the council tax reduction scheme will be welcomed by low income households. However, this cost used to be met by central government, not councils, who lose £333.2m through the system. This means the plan appears to impact on the income of councils with the most low income people. These people may well also find that any savings made on their council tax bills will not make up for cuts in the services they use or extra charges for those services. Charges now make up almost 7% of council budgets while council tax revenue has shrunk to around 15%.

All of these changes need to be effectively communicated to the public; otherwise it will be front line staff that take the flak for the confusion.

Setting up a fair property tax and rate that reflects the real values of properties is what will make the system fairer. We also need to design a system for those who struggle to meet their property tax obligations because of low incomes, which doesn’t unfairly impact on the budgets of local authorities with disproportionate numbers of low income citizens and deferment opportunities for the small group of property rich, cash poor pensioners.

While we welcome the end of the council tax freeze and improved bandings - we simply cannot go on with short-term fixes that damage services and undermine local democratic accountability.

No comments:

Post a Comment