The Joseph Rowntree Foundation has published an interim report – Coping with cuts? Local government and poorer communities - that seeks to track the impact of tighter public spending and the state of the economy on poorer people and places.

Local government spending (excluding police, schools, housing benefit) is set to fall by nearly 24% in real terms between 2008 and 2015 in Scotland.

They have found that cuts in spending power and budgeted spend are systematically greater in more deprived local authorities than in more affluent ones. This is mainly because these councils are more grant dependent. In Scotland it means that the West of Scotland councils suffer more than those from the East.

The most deprived Scottish councils reduced expenditure between 2010 and 2013 by £90 per head more than the most affluent councils did. Interestingly, the figures for England are similar, so there is little indication that the Scottish Government is targeting resources any better than the ConDems.

John Low, Policy and Research Manager at JRF, said: “This is an important and very timely report which provides graphic illustrations of how spending cuts are playing out on the ground. As we approach the fourth austerity settlement for local government in December, it is clear the cuts are biting deep into the poorest and most deprived communities. Unless we can muster the national will to correct or mitigate the unacceptable divergence of resources between more and less affluent authorities, we are slowly but inexorably creating a more divided society.”

Public Works is UNISON Scotland's campaign for jobs, services, fair taxation and the Living Wage. This blog will provide news and analysis on the delivery of public services in Scotland. We welcome comments and if you would like to contribute to this blog, please contact Kay Sillars k.sillars@unison.co.uk - For other information on what's happening in UNISON Scotland please visit our website.

Thursday, 28 November 2013

Scotland's public sector workforce

Today’s Audit Scotland’s report on the public sector

workforce shows clearly how it’s the workforce that have taken the brunt of

spending cuts.

It shows that staff costs have been cut by over £1bn between

2009/10 and 2011/12. And that doesn’t include the savings from pay restraint.

26,600 whole time equivalent (WTE) posts were cut between

March 2009 and March 2013 (7%). Some 9,665 were transferred to arms length

bodies outside the public sector. 15,816 WTE left through early departure schemes,

although these have been reducing in recent years. Councils made the biggest reduction (10%)

while the NHS had the smallest cut (1%).

The report, if anything, understates the picture because the

numbers are converted into WTE. In terms of real people (headcount), 48,700

have gone (excluding the financial sector) since the height of public sector

employment just before the financial crash - 5,500 people in the last year

alone.

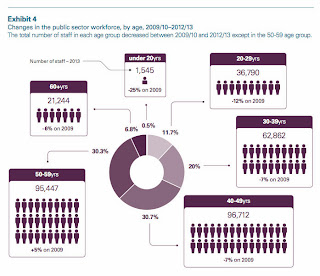

Given the scale of early departure schemes it might be

expected that the numbers of older staff would be reducing. However, the report

shows that the only age group that is increasing is 50-59yrs, up by 5%.

Probably due to recruitment freezes the numbers of younger workers are falling.

The chart below illustrates this change.

The report sets out the range of methods used by public

bodies to reduce workforce costs with pay restrictions, vacancy management and

early retirement the most common. More than a third of councils used compulsory

redundancy. There is some criticism of the level of evaluation of early

departure schemes.

Future workforce changes are inevitable given the budget

cuts to come. The report outlines a range of ways this might be achieved,

including considering service delivery cuts. The report recommends better

national and local workforce planning.

Overall, the report is a useful description of what has

happened to the public service workforce in Scotland. The recommendations are

largely sensible, but little more than a sticking plaster over the impact of spending

cuts to come.

Tuesday, 26 November 2013

Fat cats are driving inflation up

Richard Lynch in today’s Morning Star reminds us that we now have the highest inflation in the European Union and that recently announced price rises for gas, electricity, rail fares and other necessities will soon drive inflation figures up again. This will have serious consequences for UNISON members suffering from pay restraint.

He compares in detail price increases in the UK compared to our European neighbors. A look at our nearest neighbor Ireland is interesting.

“Food and drink prices increased by 35.6 per cent in Britain over the six year period, while prices in Ireland increased by only 1 per cent. Gas and electricity prices increased by 61 per cent here while prices in Ireland increased by a much lower 28 per cent. Overall inflation increased by 20.7 per cent here while Irish inflation increased by only 3.2 per cent.”

Richard then goes on to ask why is inflation so much higher in this country than in other comparable nations?

It is clearly not wages or exchange rates. He argues that it is big companies who are pushing up their prices to boost their already high profits and to give their fat-cat executives lavish remuneration packages. Outsourcing and VAT increases add to this. He concludes:

“Not only are we being fleeced by inflation, we are being taken for fools by the people who are creating it so that they can transfer cash from our pockets to theirs and increase inequality in income and wealth even further.”

He compares in detail price increases in the UK compared to our European neighbors. A look at our nearest neighbor Ireland is interesting.

“Food and drink prices increased by 35.6 per cent in Britain over the six year period, while prices in Ireland increased by only 1 per cent. Gas and electricity prices increased by 61 per cent here while prices in Ireland increased by a much lower 28 per cent. Overall inflation increased by 20.7 per cent here while Irish inflation increased by only 3.2 per cent.”

Richard then goes on to ask why is inflation so much higher in this country than in other comparable nations?

It is clearly not wages or exchange rates. He argues that it is big companies who are pushing up their prices to boost their already high profits and to give their fat-cat executives lavish remuneration packages. Outsourcing and VAT increases add to this. He concludes:

“Not only are we being fleeced by inflation, we are being taken for fools by the people who are creating it so that they can transfer cash from our pockets to theirs and increase inequality in income and wealth even further.”

Monday, 25 November 2013

Bonus culture short changes investment and pay

A key feature of UNISON’s case for fair pay is the wider economic benefit. We have highlighted the shift from wages into profits that reduce demand in the economy and are a large cause of the slow recovery from recession. We also argue that the rich spend less of their additional income, whereas low paid workers spend more in the local economy.

Duncan Weldon at the TUC has usefully summarised a range of evidence supporting this view from recent economic blogs. One paragraph from the Flip Chart Fairy Tales blog concisely makes the key historical point:

“the corporate executives of the early postwar world paid their workers high wages. This increased demand and fuelled growth but also meant that companies needed to invest. After the 1980s, executives began to take a much greater share of wealth out of their companies. They then lent it, through the burgeoning financial services industry, to their now much lower paid workers. The debt based consumption filled the gap left by the wage-based consumption of earlier years. Or, at least, it used to. What started in the 1980s as an assertion of management’s right to manage and a repudiation of the collectivist corporatism of the 1970s has resulted in a wealth imbalance that may have disastrous and long-lasting economic consequences.”

Charts in this blog show how investment has declined as well as wages on the altar of profit. This is important because many on the right argue that profit is necessary to fund investment.

This means that the way executives are rewarded, with huge bonuses linked to share prices, has encouraged short-termism and the extraction of large profits at the expense of investment. At the same time, the weakening of unions and worker bargaining power has enabled them to get away with it and has created a market for rising credit. Executive reward and corporate behaviour has therefore been a major factor leading to an economic stagnation that may last for years.

Duncan Weldon at the TUC has usefully summarised a range of evidence supporting this view from recent economic blogs. One paragraph from the Flip Chart Fairy Tales blog concisely makes the key historical point:

“the corporate executives of the early postwar world paid their workers high wages. This increased demand and fuelled growth but also meant that companies needed to invest. After the 1980s, executives began to take a much greater share of wealth out of their companies. They then lent it, through the burgeoning financial services industry, to their now much lower paid workers. The debt based consumption filled the gap left by the wage-based consumption of earlier years. Or, at least, it used to. What started in the 1980s as an assertion of management’s right to manage and a repudiation of the collectivist corporatism of the 1970s has resulted in a wealth imbalance that may have disastrous and long-lasting economic consequences.”

Charts in this blog show how investment has declined as well as wages on the altar of profit. This is important because many on the right argue that profit is necessary to fund investment.

This means that the way executives are rewarded, with huge bonuses linked to share prices, has encouraged short-termism and the extraction of large profits at the expense of investment. At the same time, the weakening of unions and worker bargaining power has enabled them to get away with it and has created a market for rising credit. Executive reward and corporate behaviour has therefore been a major factor leading to an economic stagnation that may last for years.

Friday, 22 November 2013

No more NEETs

The IPPR has published a paper that sets out a strategy for radically increasing the proportion of young people who are learning or earning, by establishing a distinct work, training and benefits track for those aged 18–24. This approach is underpinned by two new initiatives: a youth allowance, to keep young people out of the adult welfare system, and a youth guarantee, to ensure they stay in touch with the labour market.

There are over a million young people who are not in education, employment or training (NEET) in the UK, equivalent to almost a fifth of all 18–24-year-olds. Just 4% of 15–24-year-olds in the Netherlands and 7% in Denmark are NEET, compared to 14% in the UK. This is a huge waste of individual potential and imposes large, long-term costs on society.

There are three key planks to the plan:

1. A youth allowance should replace existing out-of-work benefits for 18–24-year-olds and provide financial support for young people who need it, conditional on participation in purposeful training or intensive job-search. Access to inactive benefits should be closed off for all but a very small minority. To pay for this substantial expansion of financial support for young people who are currently NEET or in further education, the youth allowance should be paid at a standard rate and be means tested on the basis of parental income until the young person is over the age of 21. This would mirror the rules for access to the higher education maintenance grant. There should also be a presumption that young people are housed by their parents until they are over 21, with exceptions for those with a child, a disability or in employment.

2. A youth guarantee should be established that offers young people access to further education or vocational training plus intensive support to find work or an apprenticeship. For those not learning or earning after six months, paid work experience and traineeships should be provided, with no option to refuse and continue receiving the youth allowance. The youth guarantee would ensure that young people can complete their initial education and gain practical employability skills, while not drifting into inactivity. To pay for this substantial expansion of provision for young people, expenditure on 18–24-year-olds in the Work Programme should be re-directed, along with adult skills and apprenticeship funding for over-24s. In addition, parents’ entitlement to child benefit and child tax credit should cease at the end of the school year after their child has turned 18, when their entitlement to youth allowance begins.

3. The government should set national objectives and priorities for the youth guarantee, but the leadership of local areas should be mobilised to organise and deliver it. Decentralisation should start with London and the eight ‘core cities’ in England taking on resources and responsibility for their young people. These cities should establish strong governance arrangements, including a central role for employers, along with plans for commissioning a diverse network of local providers. In other parts of England the youth guarantee should be commissioned nationally and delivered through existing agencies and providers (with local input wherever possible). In every area, the personal adviser model should be paramount and data on performance against headline national objectives should be regularly published. To increase opportunity and drive employer engagement, large firms that do not offer apprenticeships for young people should pay a ‘youth levy’ to train and prepare the future workforce.

There are devolved aspects of this plan that would need to be agreed by the Scottish Parliament. It also fits in well with suggestions that Scotland’s cities should take responsibility for welfare to work programmes.

There are over a million young people who are not in education, employment or training (NEET) in the UK, equivalent to almost a fifth of all 18–24-year-olds. Just 4% of 15–24-year-olds in the Netherlands and 7% in Denmark are NEET, compared to 14% in the UK. This is a huge waste of individual potential and imposes large, long-term costs on society.

There are three key planks to the plan:

1. A youth allowance should replace existing out-of-work benefits for 18–24-year-olds and provide financial support for young people who need it, conditional on participation in purposeful training or intensive job-search. Access to inactive benefits should be closed off for all but a very small minority. To pay for this substantial expansion of financial support for young people who are currently NEET or in further education, the youth allowance should be paid at a standard rate and be means tested on the basis of parental income until the young person is over the age of 21. This would mirror the rules for access to the higher education maintenance grant. There should also be a presumption that young people are housed by their parents until they are over 21, with exceptions for those with a child, a disability or in employment.

2. A youth guarantee should be established that offers young people access to further education or vocational training plus intensive support to find work or an apprenticeship. For those not learning or earning after six months, paid work experience and traineeships should be provided, with no option to refuse and continue receiving the youth allowance. The youth guarantee would ensure that young people can complete their initial education and gain practical employability skills, while not drifting into inactivity. To pay for this substantial expansion of provision for young people, expenditure on 18–24-year-olds in the Work Programme should be re-directed, along with adult skills and apprenticeship funding for over-24s. In addition, parents’ entitlement to child benefit and child tax credit should cease at the end of the school year after their child has turned 18, when their entitlement to youth allowance begins.

3. The government should set national objectives and priorities for the youth guarantee, but the leadership of local areas should be mobilised to organise and deliver it. Decentralisation should start with London and the eight ‘core cities’ in England taking on resources and responsibility for their young people. These cities should establish strong governance arrangements, including a central role for employers, along with plans for commissioning a diverse network of local providers. In other parts of England the youth guarantee should be commissioned nationally and delivered through existing agencies and providers (with local input wherever possible). In every area, the personal adviser model should be paramount and data on performance against headline national objectives should be regularly published. To increase opportunity and drive employer engagement, large firms that do not offer apprenticeships for young people should pay a ‘youth levy’ to train and prepare the future workforce.

There are devolved aspects of this plan that would need to be agreed by the Scottish Parliament. It also fits in well with suggestions that Scotland’s cities should take responsibility for welfare to work programmes.

How companies make money from forced labour

New research from the Joseph Rowntree Foundation adds timely evidence to current debates on forced labour and modern day slavery in the UK. This has been highlighted in debates at UNISON's Scottish Council and by service groups.

The research analyses how different types of UK industries make money from forced labour, this study finds that:

• How the UK economy functions creates a pool of people who are vulnerable to forced labour. People who are excluded from formal work (by policy or practice) and those in jobs at or near minimum wage levels are most susceptible to forced labour.

• Forced labour is used when it makes business sense to do so, and is strongly associated with informality in the labour market (which takes different forms in different sectors).

• Sector-specific conditions that allow for the possibility of forced labour include:

–– illegality of the product (cannabis);

–– volatility and self-regulation of labour providers (construction industry); and

–– seasonality (food sector).

Current approaches are limited in their effectiveness to prevent, detect or prosecute offences. Industry self-regulation (in some sectors of the economy) and inadequate enforcement of labour standards appears to create a sense of impunity among employers. The researchers recommend a multi-stakeholder action plan to co-ordinate activities that price and regulate forced labour out of the UK.

The research analyses how different types of UK industries make money from forced labour, this study finds that:

• How the UK economy functions creates a pool of people who are vulnerable to forced labour. People who are excluded from formal work (by policy or practice) and those in jobs at or near minimum wage levels are most susceptible to forced labour.

• Forced labour is used when it makes business sense to do so, and is strongly associated with informality in the labour market (which takes different forms in different sectors).

• Sector-specific conditions that allow for the possibility of forced labour include:

–– illegality of the product (cannabis);

–– volatility and self-regulation of labour providers (construction industry); and

–– seasonality (food sector).

Current approaches are limited in their effectiveness to prevent, detect or prosecute offences. Industry self-regulation (in some sectors of the economy) and inadequate enforcement of labour standards appears to create a sense of impunity among employers. The researchers recommend a multi-stakeholder action plan to co-ordinate activities that price and regulate forced labour out of the UK.

Tuesday, 19 November 2013

Latest Census Results

The latest report from the 2011 is now available. This report focuses on education and the labour market in Scotland. While some argue that there are more up to date statistics,the point about the census is that everyone is surveyed at the same time. The return rate is very high. In fact it's an offence not to take part. The breadth of data and the ability to cross reference each question to the other questions means there is no better source for information on Scotland's people and their lives. Key findings:

A massive 27% of people living in Scotland have no qualifications, 1% more than the proportion that has degrees or equivalent. Another reason not to cut further education budgets.

Gender segregation in the workplace continues with women making up the vast majority of workers in caring, leisure and administrative and secretarial jobs.

While more people are working, partly because there are more people, there is also a growth in part-time workers: 530,000 people now work part-time. Almost five times more women than men work part-time.

Key categories in this report are:

Qualifications

Economic activity

Hours worked

Unemployment

Industry and occupation

Socio-economic classification (class)

These are all broken down by gender, age and local authority area. All really useful information for local campaigning.

Census reports are a vital source of information and the latest report will be poured over by a range of researchers, policy makers and planners. It is the key tool for planning future public services. How many schools, nurses, roads, and houses will we need? The data also forms the basis for ensuring that all other surveys are of groups that are representative of the wider population. So when you see a spat about whether surveys are worth believing, this is how you would check.

Significantly the UK government is planning to get rid of the census, another victim of their slash and burn of public services. Danny Dorling lays out here why cancelling the census is stupid. A report will go the Scottish government in 2015 let’s hope they decide to reject the UK government’s decision and carry on with a full Scottish Census.

A massive 27% of people living in Scotland have no qualifications, 1% more than the proportion that has degrees or equivalent. Another reason not to cut further education budgets.

Gender segregation in the workplace continues with women making up the vast majority of workers in caring, leisure and administrative and secretarial jobs.

While more people are working, partly because there are more people, there is also a growth in part-time workers: 530,000 people now work part-time. Almost five times more women than men work part-time.

Key categories in this report are:

Qualifications

Economic activity

Hours worked

Unemployment

Industry and occupation

Socio-economic classification (class)

These are all broken down by gender, age and local authority area. All really useful information for local campaigning.

Census reports are a vital source of information and the latest report will be poured over by a range of researchers, policy makers and planners. It is the key tool for planning future public services. How many schools, nurses, roads, and houses will we need? The data also forms the basis for ensuring that all other surveys are of groups that are representative of the wider population. So when you see a spat about whether surveys are worth believing, this is how you would check.

Significantly the UK government is planning to get rid of the census, another victim of their slash and burn of public services. Danny Dorling lays out here why cancelling the census is stupid. A report will go the Scottish government in 2015 let’s hope they decide to reject the UK government’s decision and carry on with a full Scottish Census.

Monday, 18 November 2013

The enabling state - lessons from case studies

The Carnegie Trust have published a series of case studies to illustrate what they see as shift in public service reform from the top down state to the enabling state. They identify different language and approaches in the nations of the UK, albeit with some common themes. Four of the case studies are from Scotland and the project leader is Sir John Eldridge, former head of the civil service in Scotland.

The features of the enabling state include a shift:

• From new public management to public value

• From centralised management to localism

• Fromrepresentativetoparticipativedemocracy

• From silos and towards integration

• Fromacuteinterventiontoprevention

• From recipients to co-producers

• From state delivery to the third sector

The report highlights some themes from the case studies.

The language of co-production and asset based approaches is widely used in discussions about public service reform in Scotland. However, as these case studies show, in practice it can describe a range of different approaches. While there is broad agreement that these models can make a contribution to better service delivery, there is always a risk that inappropriate services are shoe horned into this approach. A new form of the 'one size fits all' ideology. This report is therefore a useful contribution to the debate, with all the caveats that limited case studies have for broader application.

The features of the enabling state include a shift:

• From new public management to public value

• From centralised management to localism

• Fromrepresentativetoparticipativedemocracy

• From silos and towards integration

• Fromacuteinterventiontoprevention

• From recipients to co-producers

• From state delivery to the third sector

The report highlights some themes from the case studies.

- They recognise that creating an enabling environment is not an easy task for government. A state that is too directive in its approach risks failing to make best use of existing individual and community strengths at the local level. On the other hand, a ‘hollow’ state that simply withdraws and leaves communities to ‘get on with it’ risks exacerbating inequalities.

- There is a risk that communities with limited connections within their communities and to professionals and influential people or organisations are left behind. This has been a feature of many community based approaches in Scotland. Almost all of the case studies where co-production occurred operated on a voluntary basis.

- Equally there are a number of barriers to transformational change as 'tinkering around the edges' or incremental change is seen as less effective. These barriers can include existing structures and cultures.

- The case studies emphasised the length of time required for development and implementation. Investing in enough staff with the right mix of skills, experience and personal attributes is vital.

The language of co-production and asset based approaches is widely used in discussions about public service reform in Scotland. However, as these case studies show, in practice it can describe a range of different approaches. While there is broad agreement that these models can make a contribution to better service delivery, there is always a risk that inappropriate services are shoe horned into this approach. A new form of the 'one size fits all' ideology. This report is therefore a useful contribution to the debate, with all the caveats that limited case studies have for broader application.

Fat cats getting fatter

The latest IDS report shows that top Directors earnings increased by 14% in the last year while average earnings fell in real terms. The CBI has been noticeably quiet today about the need for public sector pay restraint!

The big increase came with a 58% rise in the value of vested long-term incentive plans (LTIPs) – share-based schemes linked to shareholder returns, but even basic pay increased by 4%. In contrast, average earnings across all sectors grew by 2.1% and have fallen in real terms for most of the past five years. Even more so in the public sector.

The median salary was £568,500, annual bonus £553,200 and vested LTIP awards £1.2bn. However, most listed companies’ annual accounts do not include vested share awards in the main table detailing with directors’ pay, making it difficult to spot. That will change with new reporting requirements.

Frances O’Grady, General Secretary of the TUC, said: “It’s one thing replacing bonuses with long-term incentive plans, but FTSE 100 companies are simply exploiting this change to make their fat cats even fatter. The time has come for legislation to put ordinary workers on the pay committees of companies. This is the only way to bring some sanity to the way in which directors are paid.”

The big increase came with a 58% rise in the value of vested long-term incentive plans (LTIPs) – share-based schemes linked to shareholder returns, but even basic pay increased by 4%. In contrast, average earnings across all sectors grew by 2.1% and have fallen in real terms for most of the past five years. Even more so in the public sector.

The median salary was £568,500, annual bonus £553,200 and vested LTIP awards £1.2bn. However, most listed companies’ annual accounts do not include vested share awards in the main table detailing with directors’ pay, making it difficult to spot. That will change with new reporting requirements.

Frances O’Grady, General Secretary of the TUC, said: “It’s one thing replacing bonuses with long-term incentive plans, but FTSE 100 companies are simply exploiting this change to make their fat cats even fatter. The time has come for legislation to put ordinary workers on the pay committees of companies. This is the only way to bring some sanity to the way in which directors are paid.”

Thursday, 14 November 2013

Police centralisation process criticised by Audit Scotland

Today’s Audit

Scotland report finds that the Scottish Police Authority and Police Scotland

face continuing challenges in delivering the savings required. In particular, their

limited flexibility in managing police officer and staff numbers. That’s polite

auditor criticism of the political police officer target imposed on Police

Scotland.

The report also

confirms some key UNISON criticisms of the process leading up to the

centralisation of Scotland’s police forces. In particular, that the savings

estimates were based on an Outline Business Case that has never been updated or

moved on to a Full Business Case.

“Both KPMG and PwC highlighted significant

concerns

about financial management in addition to the issues identified by the gateway

reviews.

A number of recommendations from these reviews were not fully

implemented, including the gateway review recommendation to update and use the

business case to test the validity and realism of programme assumptions.”

In addition, the

report highlights the confusion over the roles of the SPA and Police Scotland -

a confusion that was played out in public over many months. UNISON Scotland

drew attention to the potential for conflict, given the lack of clarity, while

the Bill progressed through Parliament.

The report says:

“There

were a number of areas of tension, including:

· different interpretations of the Act, the

Scottish Government’s intention behind the Act, and what this meant for the

role of the SPA in terms of ‘maintaining’ the police service

· the lack of good baseline information on

non-operational police activity; in particular, the lack of comprehensive

financial information to identify how savings outlined in the OBC would be

achieved

· a lack of shared understanding and expectations

over what effective scrutiny of the police service looked like in practice

· the Scottish Government’s changing position over

the way the SPA should operate.”

The report goes on

to express concern that a number of governance issues still need to be

progressed.

This report

articulates what everyone close to the process knows. This was a badly planned

and rushed centralisation of a vital public service, with flawed legislation

and a confused governance structure. The estimated savings were optimistic and

more importantly, not worked up in sufficient detail. Add to all that political

targets on police officer numbers that makes a nonsense of the statutory duty

of Best Value.

Huge challenges

remain, but even at this stage it would help if the Scottish Government stopped

its political interference and allowed Police Scotland to adopt a balanced

workforce.

Wednesday, 13 November 2013

What policy changes do families need in post-crash Britain?

A new briefing from IPPR explores the central problems and

anxieties affecting families across Britain today. The first of their

‘Condition of Britain’ papers.

They highlight five main areas of concern:

·

Financial pressures caused by poor growth in

real wages and price increases on essentials like energy, food, fares and

childcare.

·

Finding time for each other due to long working

hours and poor family leave policies.

·

Money and domestic responsibilities put pressure

on relationships leading to higher rates of divorce and separation.

Geographical mobility weakens family support mechanisms.

·

Parents do a good job, but need support. Stress

and poor mental health is on the increase.

·

Certain markets intrude into family life skewing

children’s priorities towards material goods and away from quality

relationships.

The paper then sets out some lessons for policy and action.

These include:

·

The importance of a decent income, not just

benefits.

·

Strong relationships matter and this means more

than just a tax break for married couples.

·

Parents need practical help, not isolation or

blame.

·

We need strong families who are able to stand up

to market pressure.

This is a really useful contribution to the debate about the

pressures and support families need.

Understanding the economy

The latest economic data can appear pretty confusing, if not contradictory.

Yesterday the Consumer Prices Index (CPI) fell from 2.7% to 2.2%, the lowest level for a year. This apparent good news was largely driven by fuel price cuts as supermarkets engage in a price war. Reductions in fuel prices will help some UNISON members. However, many more will be concerned about the 4.3% increase food prices and that household energy price increases, of up to 10%, are not included in these figures. These are not discretionary costs and are all well above the typical 1% increase in pay.

Today’s jobs data shows that Scotland is -0.2% below the 2008 peak. So after more than 5 years of austerity economics we are almost back to where we were in terms of the number of jobs. The UK is still doing slightly better, having already attained its pre-recession peak, but with 75,000 jobs created in Scotland over the past year, jobs growth was faster here than anywhere else. However, unemployment increased in Scotland by 1,000 while it fell across the UK. The numbers of inactive are falling and this may mean that better job prospects are attracting more workers back into the labour market. The number of full time workers in Scotland is still some 7% below the pre-recession peak.

So in summary, there is some good economic news. However, wages are still being squeezed and that won’t help create a sustained economic recovery. While new jobs are being created they are still part-time and less secure than before the recession.

Further reading.

The TUC’s Duncan Weldon has published ten charts to help understand the economy. This is very good.

Brian Ashcroft explains what’s happening in the Scottish jobs market.

Yesterday the Consumer Prices Index (CPI) fell from 2.7% to 2.2%, the lowest level for a year. This apparent good news was largely driven by fuel price cuts as supermarkets engage in a price war. Reductions in fuel prices will help some UNISON members. However, many more will be concerned about the 4.3% increase food prices and that household energy price increases, of up to 10%, are not included in these figures. These are not discretionary costs and are all well above the typical 1% increase in pay.

The Bank of England’s quarterly inflation report has raised

growth forecasts, but it still doesn’t expect unemployment to fall below 7%

until next year. That is significant because that’s the earliest they will even

consider raising interest rates. Mortgage cost increases are something else

UNISON members don’t need at present.

So in summary, there is some good economic news. However, wages are still being squeezed and that won’t help create a sustained economic recovery. While new jobs are being created they are still part-time and less secure than before the recession.

Further reading.

The TUC’s Duncan Weldon has published ten charts to help understand the economy. This is very good.

Brian Ashcroft explains what’s happening in the Scottish jobs market.

Subscribe to:

Comments (Atom)